|

| |

|

|

Dear Shareholders,

It is our pleasure, on behalf of the Board of Directors to present the Annual Report and Audited Financial Statements of JcbNext Berhad (“JcbNext” or “the Group”) for the financial year ended 31 December 2024.

FINANCIAL PERFORMANCE

For the financial year ended 31 December 2024, the Group recorded revenue of RM14.62 million, profit before tax of RM51.78 million and a profit attributable to shareholders of RM51.12 million, representing year on year (“YoY”) increase of 34.0%, 25.3% and 44.0% respectively. The growth is brought about by a 26.7% growth in dividend income from equity investments from RM7.86 million in 2023 to RM9.96 million in 2024. In addition, the Group’s interest income had increased 116.4% to RM3.24 million in 2024 driven partly by the increase in cash as well as the prevailing high interest rates during the year. We also continued to sell shares of 104 Corporation (“104 Corp”) in the open market during the year which contributed gains amounting to RM34.03 million to our bottom line. These gains alone accounted for approximately 66% of the net profit for FY 2024. I would like to caution that the gains on the disposal of 104 Corp shares are not part of operating activities in the strict sense of the term and that shareholders should not expect these gains to recur indefinitely. The disposals stem from a need to manage concentration risk and how much gains we can continue to record from the disposals going forward will also depend on market conditions and the share price performance of 104 Corp. Moving on, the Group’s operating expenses had increased by 69.7% YoY to RM7.89 million in FY 2024 from RM4.65 million in the preceding year. While this looks bad on the surface, upon further inspection, operating expenses had included foreign exchange losses amounting to RM3.27 million. These foreign exchange losses were mainly from the Group’s foreign denominated bank deposits and arose due to the weakening of the USD and the strengthening of the MYR from the third quarter onwards. While a lot of it has to do with the US Federal Reserve pivoting to monetary easing in 2024, favourable domestic factors had also contributed to the strengthening of the MYR. It is good to see dividends from our equity investments continuing to grow year-on-year which is in line with our objective of growing free cash flows which can then be distributed back to you, our shareholders. The higher dividend income also means our dependence on our associates, in particular 104 Corporation, is gradually reducing and we can have a more diversified income base.

To have a balanced picture of the financial performance of the Group during the year, we would also have to look into the consolidated statement of financial position, specifically in equity. The Group’s net assets grew by RM37.57 million or 10.4% YoY. Apart from the net profit of RM51.12 million, an increase in the fair value through other comprehensive income (FVOCI) equity investments amounting to RM19.37 million had also contributed to the growth in net assets. However, these were partially offset by foreign currency translation losses of RM14.37 million on 104 Corp as well as the payment of dividends amounting to RM17.76 million during the year. Unlike 2023, JcbNext had paid dividends twice in 2024, namely the final dividend of 6.5 sen for FY 2023 in July 2024 and the payment of an interim dividend of 7.0 sen in December 2024. As a result of all these factors, net assets or shareholders’ funds increased from RM362.15 million in 2023 to RM399.72 million in the current financial year. As at 31 December 2024, our total assets stood at RM409.16 million (2023: RM371.66 million) with liquid cash and short-term investments in money market funds totalling RM107.20 million (2023: RM109.57 million). Total equity attributable to shareholders amounted to RM399.72 million (2023: RM362.15 million) with a book value per share of RM3.04 (2023: RM2.74).

A detailed discussion of the Group’s financial performance can be found in the Management Discussion and Analysis included in this Annual Report.

DIVIDEND

On 9 December 2024, the Board of Directors announced the declaration of an interim single-tier dividend of 7.0 sen per share for the financial year ended 31 December 2024 which was paid on 31 December 2024. The Board does not recommend the payment of a final dividend. For the financial year ended 31 December 2023, a final dividend of 6.5 sen was paid on 25 July 2024.

CORPORATE DEVELOPMENTS

2024 saw the Group, for the most part, acquiring more equity investments. During the year, the Group had invested an additional RM61.11 million into its equity portfolio. In a way, this reflects our investment philosophy of patiently building up a collection of good businesses that can provide us with a regular stream of dividends. We will not buy if such buying is inconsistent with our investment strategy and criteria. During the year, the Group had also sold some investments amounting to RM7.27 million (excluding the disposals of 104 Corp shares) and such disposals are driven by a combination of factors such as changes in the fundamentals of the underlying companies and for rebalancing the equity portfolio. I wish to reiterate that JcbNext remains a long-term investor and does not engage in short-term speculative trading of shares.

GOING FORWARD

Here we are in 2025 and we find ourselves in choppy waters. The raft of tariff announcements, retaliatory measures and escalating trade war have rocked markets and left investors on edge. Tariffs could raise prices, slow consumption and raise the likelihood of a recession. President Trump’s sweeping tariffs have left many wondering how these tariffs were formulated and what the endgame is. One key ingredient in business investment decisions is certainty and the irony right now is that uncertainty is the only certainty. At the time of writing, President Trump has announced a 90-day pause on the reciprocal tariffs which has restored some calm to markets, albeit only temporary. No one knows how this situation will play out after this. In these turbulent times, JcbNext will stay the course and focus on what we can control. Work continues to find undervalued gems: resilient companies with good business fundamentals that will allow them to ride out this storm, and hopefully we will all be able to enjoy the fruits of this effort in the years to come. Buckle up, we're in for a rollercoaster ride!

SUSTAINABILITY

The Group continues to endorse principles of sustainability in its business operations and corporate activities. We are pleased to present to you our Sustainability Report in the Annual Report where you can find our thoughts on the matter and also some of the initiatives that are already in place.

APPRECIATION

We would like to record our appreciation to all our employees, valued partners, business advisers and shareholders for your continued support during the past year.

DATUK ALI BIN

ABDUL KADIR

Chairman

|

|

| |

|

|

| LETTER FROM THE CHIEF EXECUTIVE OFFICER |

| |

|

|

Dear Shareholders,

Overall performance

Our company recorded a revenue of RM14.6 million in FY2024, an increase of 34.0% from the RM10.9 million in FY2023. Net profit attributable to shareholders rose to RM51.1 million, 44.0% higher than the RM35.5 million figure in FY2023. However, as shared previously, I believe accounting revenue and profit numbers are often less relevant in explaining the economic substance of our company due to the nature of our business.

FY2024 was again a year when the growth in our accounting profits – in my view – grossly overstated the economic substance of our performance. Among developments captured in the RM51.1 million profit included: i. RM34.0 million accounting gain on disposal of investment in an associate, and ii. RM3.3 million foreign exchange losses. The RM34.0 million gain on disposal was recognised mainly from the partial sales of our shareholding in Taiwan-listed associate 104 Corp, at a price higher than its carrying value on our books. I believe transactions of such nature merely convert our “investments” into “cash” and should not be deemed to have increased our “profitability” levels.

Recognising gains from such transactions could be problematic in two ways. First, we started investing in 104 Corp in 2008 and have held on to most of the shares until the partial divestment exercise began in 2021. The “value creation” of this investment for our portfolio obviously did not occur only from 2021 (as suggested by the “realised gains” that started showing up in our financial statements), but was a culmination of the decision by earlier management teams making the investment, as well as their patience to have held on to the position for more than 13 years. They planted, watered and tended the mango tree – we simply reached out and picked the fruit. To make things worse, if we do not succeed in growing new trees, eventually there will be no fruits left to harvest.

Second, emphasising on this version of “profitability” could easily allow a more “creative” management team, sitting on investments with similarly large unrealised gains, to decide when they want accounting “profits” to increase and by how much. If such management wants to perform “better” that year, they can just sell more of those positions – even if it might not be in the best interests of shareholders – and “profits” will magically appear. Unfortunately, due to existing accounting standards, you will continue to see such anomalies in our results.

The following are a number of key data points that our management team actually focuses on, that I hope would give you a more complete picture of our performance. Unlike many investment funds, we emphasise much more on growing the recurring cash flow that we receive - including dividends, interest income and rental - than fluctuations in the market value of our holdings. In 2024, we continued to increase our free cash flow generation, but far lower than the 44%-plus growth suggested by our accounting “profits”:

- Cash Generation: Our assets produced dividends, interest and rental incomes of about RM24.5 million in 2024 before taxes, a 3.7% increase from RM23.6 million in 2023. This can be traced back to an increase in dividends from our new equity portfolio (more on this later in the letter) and higher interest income, partially offset by a decrease in dividends received from 104 Corp due to a further reduction in our shareholding, and the HKEX-listed Lion Rock due to a higher dividend base in 2023.

- Management Expenses: Staff costs and other operating expenses at our investment holding operations were RM3.5 million in 2024, an increase of about 4.8% from 2023. This excludes forex gains or losses. The RM3.5 million figure is about 0.8% of our 2023 year-end Net Asset Value (NAV) of RM457.9 million (note NAV definition below).

- Free Cash Flow/ Dividends: Deducting taxes and making some other smaller adjustments, the free cash flow generated by our business is estimated to have increased by about 6.1% from RM17.0 million in 2023, to RM18.1 million in 2024. Of this amount, around 50% was distributed as an interim dividend in December 2024. This translated to us paying out a dividend of RM 0.07 per share from our 2024 free cash flow, slightly higher than the previous dividend of RM 0.065.

Note that we brought forward the FY2024 dividend payment in anticipation of the Dividend Tax introduction in Malaysia for 2025. As a result, we do not expect to issue another dividend in the 2025 calendar year, with the next one anticipated in mid-2026.

- Book Value: As at 31 December 2024, the book value (BV) of our company stood at about RM399.7 million, the biggest component of which are RM278.7 million in marketable securities including stakes in our listed associate companies (104 Corp and Innity), RM107.2 million in cash and money market funds, and RM18.5 million in investment properties, with no material debt. This book value figure increased by approximately 10.4% compared to 2023.

- Net Asset Value: If we had calculated the value of our assets using the market prices of our associates, rather than what is shown on our balance sheet, the figure - which we would loosely call the Net Asset Value (NAV) - would be RM465.0 million at the end of 2024, an increase of 1.5% compared to 2023. Adding back dividends distributed in July and December 2024 would bring our NAV to about RM482.8 million, an increase of about 5.4% year-on-year.

Larger business investments

I usually take this chance to repeat what we hope to offer to you: helping preserve your purchasing power, grow wealth gradually, and deliver a regular income stream through dividend distributions. To achieve this, we focus on building a collection of good companies, typically through smaller stakes rather than large, concentrated positions. Our long-term goal is to increase the dividend per share over time, while managing downside risks by building up a diversified, conservative and sustainable portfolio.

104 Corp

Our largest investment, 104 Corp in Taiwan, delivered a 3.9% year-on-year increase in after-tax profit in 2024, building on prior growth of 1.4% in 2023, 20.6% in 2022 and 43.2% in 2021. As cautioned in my past letters, despite the tailwind from a strong semiconductor industry in Taiwan, the exceptional growth seen in 2021 and 2022 was unlikely to be sustained over a prolonged period, given the inherently competitive nature of the capitalist system – much as we admire the 104 business and its management team.

However, we remain very happy and satisfied shareholders, and are cautiously optimistic that the current management team will continue to work diligently to create value for shareholders like us. The company has again announced that they intend to pay out 100% of their 2024 profits as dividends, which we should receive later this year. 104 Corp’s business model enables it to grow with minimal capital reinvestment - thus most of its profits can be distributed as dividends to shareholders like us.

In 2024, we received dividends of around RM8.6 million from 104 Corp, giving us a dividend yield of about 18.9% based on our Ringgit cost (which includes the impact of TWD appreciation against the Ringgit). As shared previously, we first invested in 104 Corp in 2008 as part of a strategic plan to expand JobStreet’s online footprint. Today’s strong dividend yield will continue to remind us of the merits of investing long-term in quality businesses led by capable management teams, while remaining patient. I quote Charlie Munger: “The big money is not in the buying and the selling, but in the waiting.”

Over the last year, we have continued selling down a small portion of our 104 Corp holding reluctantly. As shared previously, the decision is driven almost entirely by our hope to diversify our portfolio further - 104 Corp still makes up about 28.9% of our NAV as at the end of 2024 (or 16.8% if calculated based on our book value). The shares were sold via open market transactions, and we continue to believe that the buyers of our shares can take great pride in owning such an outstanding business.

Other larger business investments

Our other business investments saw mixed performances in 2024.

Lion Rock’s profit attributable to owners increased by 15.7% to HKD214.4 million in 2024 from the previous year, driven by stronger performance of its print manufacturing business and higher profit contributions from its London-based publishing company Quarto. Much like 104 Corp, I believe Lion Rock is led by a management team that has exceeded our expectations time and again, in an industry often overlooked by outside observers. In 2024, we received dividends of around RM3.8 million from the company, which translated to a dividend yield of around 14.4% based on our cost. These numbers capture the true joy of long-term dividend investing.

That said, it is worth noting that almost 50% of Lion Rock’s 2024 revenue from external customers came from the US, making the company potentially vulnerable to disruptions arising from the escalating global trade tensions. The company noted in its financial reports that printed books “appear to be exempt” from the initial US tariffs on Chinese goods, but cautioned that this status could change with future policy developments.

Elsewhere, our ACE market-listed associate Innity reported a widened loss of RM7.6 million in 2024, compared to a RM1.1 million loss in the previous year - attributed to a decline in gross profit margins and higher operating expenses. Hastings in Australia faced another challenging year, with prices of rare earth elements NdPr remaining relatively low. However, a positive development emerged with the successful renegotiation of its convertible note due this year, although the deal did result in a significant dilution of our stake in the Yangibana mine.

As in previous years, my colleagues have prepared a much more comprehensive (and better!) description of the corporate developments for some of our investments in the MD&A section of this annual report for your reading.

Equity portfolio

I will spend more time on our new equity portfolio in this year’s annual letter, as it has grown in both size and importance for us.

Portfolio updates

In 2024, we continued to build up our shareholding in public-listed businesses in the Asia Pacific region. We invested another RM61.1 million into this equity portfolio, bringing our cost of investment in this portfolio to RM147.5 million as at the end of 2024. In the first quarter of 2025, we invested a further RM15.5 million, disposed RM3.2 million (at cost), bringing the total investment to RM159.8 million (at cost).

As at the end of Q1 2025, our equity portfolio comprises 29 companies and 2 ETFs, with a market value of about RM185.9 million. It remains heavily weighted toward businesses with a strong dividend-paying histories, with Chinese banking and insurance companies making up about 29.4% of the portfolio (not including “indirect” exposure via ETFs), followed by Chinese internet and technology companies 18.2% and Chinese/ Hong Kong property companies 15.1%.

A big part of our new investments from January 2024-March 2025 was directed toward Chinese companies. We initiated positions in several Chinese/ Hong Kong property companies, increased our exposure to the internet and technology sectors in the country, and added select “deep value” opportunities in Malaysia. By the end of March 2025, about 74.2% of this equity portfolio is invested in Chinese companies, and the remainder spread across markets including Malaysia, Australia and Singapore. We believe these businesses could provide a strong foundation on which to build a resilient, long-term portfolio.

China

I remain optimistic about the long-term prospects of the Chinese economy – thinking in terms of years or even decades, not days or months.

The Chinese market saw a dramatic rally in September last year, only to be followed by an equally sharp pullback, reigniting debates over whether the country is indeed “uninvestable”. In my view, these abrupt swings in sentiment – from euphoria to fear – reflect a deep disconnect between external investors, especially those viewing China through a Western lens, and the Chinese government’s approach to economic management.

Rather than launching bold, sweeping stimulus packages, the Chinese leadership appears to favour a more measured, pragmatic route – what they describe as “crossing the river by feeling the stones” ( 摸着石头过河): a trial-and-error, incremental approach to navigating complex challenges. For investors expecting a dramatic, “whatever it takes” response, this gradualism can appear underwhelming. However, if executed with consistency, I believe this deliberate strategy could prove more effective in addressing China’s structural issues over the long term.

Most of our new investments in China were made either before sentiment began to turn more optimistic in September 2024, or after the market pulled back toward the end of 2024 and into early 2025. In Q1 2025, sentiment improved considerably (before “Liberation Day” – more on that below!), with the Hang Seng Index gradually climbing to the 23,000-24,000 range. While this has resulted in some “paper gains”, what truly matters, in my view, is that we secured partial ownership in a number of excellent businesses – gaining a share of their profits and cash flow - at decent prices.

That said, I must caution that the timing of our investments in China should not be mistaken for a newfound ability of our team to “time the market” or predict economic cycles. We were simply fortunate that some of our larger positions were established shortly before sentiment began to turn. Our approach remains firmly “bottom-up” – we made these investments because we believed the underlying businesses were undervalued, not because we anticipated a rally. The volatility since the “Liberation Day” tariffs should remind us that we will continue to experience significant fluctuations in our NAV.

Further, given the diversified nature of our portfolio, any strong performance of individual holdings is naturally diluted across the broader portfolio. As a result, even if we are fortunate enough to own a business that experiences a tenfold increase in profitability, or if a market we’re heavily invested in sees a sharp rally, we should only expect our overall portfolio performance to reflect those upswings partially.

Portfolio turnover

We have sold only RM12.7 million worth of investments from this portfolio, since we started building it up in 2020. By design, our portfolio turnover will be significantly lower than a more traditional fund management firm. As described in my letter to you in previous years: we view smaller equity investments as part-ownership of good businesses and it’s our intention to hold such investments for the long term. We do not view them as a series of flashing stock tickers, arrows and numbers that we should trade on at every opportunity.

Dividends

In 2024, our equity portfolio generated RM6.2 million in dividend before taxes – a decent jump from the RM3.8 million in 2023. This growth was mainly driven by higher capital deployed into the portfolio, receiving full-year dividends from investments made in 2023, as well as some ad-hoc dividends we received ahead of the introduction of Malaysia’s Dividend Tax.

Based on a cost base of RM147.5 million, our portfolio delivered a dividend yield of around 4.2% in 2024. This was largely supported by our “dividend” investments, with most generating yields in the range of 5-10%+ (on cost). However, the average yield across the portfolio was lower, as it includes a mix of “growth” positions and ETFs, both of which generally pay minimal or no dividends.

As shared in last year’s letter, our long-term aspiration is to build our own mini Yangtze river – with steady dividend “streams” flowing from a broad base of high-quality, long-term holdings, rather than relying on just a few large investments. This diversification means that if a few streams dry up temporarily, many others may continue to flow uninterrupted, helping to cushion the impact of unexpected setbacks. The cash inflows from these dividend streams would be partly distributed to our shareholders, and partly reinvested into new opportunities. Having a stable and recurring source of dividend income gives us greater confidence to allocate some capital into higher risk/ reward opportunities or deep value situations – investments that may take longer to realise their potential (if at all).

There are no guarantees of success on this journey, but I believe the stronger our ability to allocate capital into long-term, cash-generative businesses – and the longer-term our perspective – the greater our chances of successfully building our own version of the Yangtze river.

"Liberation Day"

A draft of this letter was completed on April 4, the same day China retaliated against President Trump’s “Liberation Day” tariffs with a 34% counter-tariff. Global macroeconomic events are unfolding at breakneck speed. Factors that once drove global growth now appear to be fading rapidly, triggering a sharp shift in sentiment – from talk of US exceptionalism to fears of stagflation and a potential global recession, all within a matter of weeks. The world feels on edge.

However, despite the rising risk of a global downturn, I must reiterate that we do not claim the ability – or the talent – to make meaningful forecasts about the future, especially in these times of heightened uncertainty. While it is certainly possible that all the worst headlines we’re seeing could materialise, it is also plausible that policies will shift, rhetoric will soften, and outcomes may turn out far less severe than anticipated. My perspective on this matter is influenced by Howard Marks, who describes macro forecasting as the “illusion of knowledge”. He echoes Warren Buffet’s view that for information to be truly useful, it must be both “important” and “knowable”. While macro developments are undoubtedly important, they are rarely knowable with the precision required to inform our investment decisions effectively.

So, in the face of such uncertainty, I believe it would be prudent to focus on what is within our control: i) Reviewing our portfolio to ensure we’re not overly exposed to high-risk businesses, ii) Maintaining zero debt – including avoiding leverage in our investments, and iii) Keeping a sizable war chest ready to deploy in the event of a broad market sell-off.

As of end-2024, we held around RM107.2 million in cash and cash equivalents - about 26.8% of our net book value, or 23.1% based on our NAV of RM456.0 million. I believe this provides a healthy cushion in the current environment. If a significant correction takes place in a key global market where we aim to build long-term exposure – such as the US – we could deploy some of our capital quickly. However, if no such opportunity arises, we will simply continue doing what we’ve always done: seeking out undervalued pockets in the market, patiently and selectively.

That said, shareholders should remain mindful that extended market downturns can and do happen. We must be prepared for the possibility that our portfolio value could decline by 50% or more. In extreme scenarios, cash inflows could even fall to zero, making dividend payments impossible. However, if the businesses we own are fundamentally sound, I believe they will endure – and in time, so too will our portfolio recover.

At the office

We continue to operate with a small, but highly effective team. The team’s contributions – across investment research, reporting, operations and sustainability – have been invaluable. I would certainly have many more sleepless nights without any one of them. This year has also marked a paradigm shift in the capabilities of AI tools and we are keen to keep learning. If you come across interesting applications that could support our operations or investment research, I would love to hear about them!

Thank you

Finally, I would once again extend my sincere thanks to our long-term shareholders. My commitments from previous years remain unchanged – while we cannot guarantee immediate results - we will continue to treat you as true “partners”, maintain alignment of interests, and work hard to steadily grow our portfolio of quality businesses, for our mutual benefit.

CEO

Lionel Liong Wei Li

24th April 2025

|

| MANAGEMENT DISCUSSION AND ANALYSIS |

| |

|

|

OVERVIEW

JcbNext Berhad (“JcbNext”) is an investment holding company. It owned and operated the JobStreet.com online job portal business from 2004 to 2014. In 2014, the job portal business was sold to SEEK Ltd for close to RM2 billion with the net proceeds paid as dividends to shareholders. Today, the Company has stakes in associates, 104 Corporation, the largest job site in Taiwan and Innity Corporation Berhad, a leading provider of interactive online marketing platforms and technologies in Malaysia. It also operates the Autoworld automotive content website. JcbNext also has quoted investments in Malaysia, Hong Kong/ China, Singapore and Europe and owns an 8-storey office building in Kuala Lumpur.

THE STATE OF THE GLOBAL ECONOMY IN 2024

The global economy grew by 3.2% in 2024. The global economic landscape was shaped by moderate but uneven growth, ongoing inflationary pressures, and shifting monetary policies. While developed economies like the U.S. remained resilient, driven by strong consumer demand and AI-driven investments, China’s slowdown due to property market struggles and weak domestic consumption weighed on global trade. Europe faced stagnation, grappling with high energy costs and subdued industrial activity, while emerging markets saw mixed performances, with some benefiting from commodity exports and others struggling with inflation and capital outflows. Central banks signalled potential rate cuts as inflation cooled, fuelling stock market optimism, particularly in the tech sector. However, geopolitical tensions, supply chain shifts, and energy price volatility continued to pose risks to global stability.

The U.S. economy remained resilient, with GDP growing 2.8%, outperforming earlier recession fears. This expansion was fuelled by strong consumer spending, labour market stability, and technological innovation, particularly in artificial intelligence and semiconductor industries. US consumers continued to drive economic growth, supported by higher wages and low employment. The US labour market remained strong with unemployment hovering around 3.7%, close to historic lows. Job creation continued, though at a slower pace than previous years, as businesses adapted to higher borrowing costs. Trade tensions, particularly between the US and China, remained high, with semiconductor restrictions and supply chain diversification being major themes. The Federal Reserve maintained a cautious monetary policy, initially keeping interest rates high to curb inflation before implementing a total of 100 basis points in rate cuts in the last four months of the year, helping sustain economic momentum. Inflation moderated, nearing the Federal Reserve’s 2% target, though housing costs and wage pressures remained areas of concern. Stock markets, led by the S&P 500 and Nasdaq, reached record highs amid investor optimism. However, concerns persisted over rising federal debt, housing affordability, and business investment constraints due to high borrowing costs. The US dollar (“USD”) experienced a mixed performance in 2024, strengthening in the first half of the year as the Fed kept interest rates high before weakening in the latter months as the rates cuts were implemented. The greenback’s movement were also influenced by global risk sentiment, with geopolitical uncertainties and China’s economic slowdown boosting demand for the USD as a safehaven asset.

The Eurozone economy in 2024 remained fragile and weak, with GDP growth estimated at 0.9%, reflecting stagnation across major economies like Germany and France. High inflation, elevated interest rates, and weak industrial output dampened economic momentum, while consumer spending remained weak weighed down by persistent inflation, high interest rates and sluggish wage growth. Geopolitical risks, including the ongoing Russia-Ukraine conflict and global trade tensions, further dampened business confidence, while the energy sector remained volatile with natural gas prices stabilizing but still above prewar levels. The European Central Bank (ECB) pursued a gradual easing cycle in 2024, cutting interest rates four times by a total of 100 basis points, bringing the deposit facility rate from 4.00% to 3.00% by year-end as inflation moderated closer to the ECB’s 2% target and economic growth remained sluggish. Energy costs and supply chain disruptions continued to impact manufacturing, particularly in Germany’s automotive sector. However, green energy investments and resilient labour markets provided some economic support.

The UK economy in 2024 remained sluggish, with GDP growth estimated at 1.1%, reflecting persistent economic challenges. High inflation and elevated interest rates constrained consumer spending and business investment, while the housing market remained weak due to rising mortgage costs. The labour market showed resilience, but productivity growth remained sluggish. The post-Brexit trade environment continued to weigh on exports, while geopolitical uncertainties and weak global demand limited economic momentum. Although the services sector, particularly finance and technology, provided some support, overall economic activity remained subdued, with concerns over long-term growth prospects. The Bank of England maintained restrictive monetary policy in the first half of 2024, as inflation remained elevated at around 4%, well above the BoE’s target of 2%, driven by persistent service sector prices and wage growth pressures. However, inflation gradually declined to around 2.8%-3% by year-end, allowing BoE to cut interest rates twice by a total of 50 basis points.

China's economy in 2024 faced moderate growth challenges, with GDP expanding at an estimated 5%, lower than pre-pandemic levels but still outpacing many developed economies. Growth was largely driven by government stimulus measures, infrastructure investment, and exports of high-tech products such as electric vehicles and semiconductors. However, a prolonged property crisis, weak consumer confidence, and sluggish foreign investment weighed on economic momentum. The Chinese government responded with fiscal stimulus measures, monetary easing, and incentives for manufacturing and exports, but structural concerns—including a shrinking workforce, mounting local government debt, and global trade tensions, limited recovery. China’s export demand in 2024 was strong, driven by its position in high-tech industries like electronics, EVs, and solar panels, sustained demand from major trading partners, and ongoing trade agreements such as RCEP. While facing challenges from tariffs and global supply chain shifts, China’s flexibility in adjusting its export strategies and its dominance in key sectors allowed it to maintain robust export growth despite external pressures. China’s trade surplus reached record levels in 2024, with exports growing by 5.9%.

Southeast Asia’s economy grew at an average rate of 4.7% in 2024. Growth was driven by a mixture of domestic consumption, increased manufacturing exports and government infrastructure investments. Vietnam saw the highest growth, expanding at an impressive pace of 7.09%, driven by strong manufacturing exports, particularly in electronics, textiles and consumer goods. Additionally, its digital economy, foreign direct investment inflows and increased domestic consumption supported growth. Vietnam's ability to capture a significant portion of global supply chains, especially in electronics, positioned it as a key player in the region’s economic recovery. The second best performing economy in Southeast Asia in 2024 is the Philippines, whose GDP grew by 5.6%. The country’s economy benefited from a combination of factors, including a recovery in key sectors such as tourism, manufacturing and services, along with substantial investments in infrastructure. The Philippines' robust services sector, particularly in business process outsourcing, continued to thrive, providing stable growth in the economy. In addition, the steady flow of remittances from Filipino workers overseas remained a vital pillar for the economy. Remittances account for a significant portion of household incomes and continue to support domestic consumption. In 2024, the Philippines received a record USD38 billion in remittances, providing a crucial buffer against inflationary pressures and contributing to consumer spending. The third best performing economy in Southeast Asia in 2024 is Indonesia with its GDP growing by 5.03%. Indonesia’s economy benefited from a rise in domestic consumption, government spending on infrastructure and a surge in exports of commodities like coal, palm oil, gas and minerals. The country’s digital economy also grew rapidly, with sectors like e-commerce, fintech and logistics expanding, further boosting the economy. Its manufacturing sector, particularly in key industries such as electronics, automotive, textiles, chemicals and food processing, continue to play a crucial role in the country's economic performance, contributing significantly to its GDP growth and supporting its overall recovery. The government’s focus on infrastructure development, particularly in transportation and renewable energy, helped create jobs and stimulate economic activity.

Let’s now look into the performance of Malaysia’s economy in 2024. For the year as a whole, the Malaysian economy grew by 5.1% in 2024 (2023: 3.6%), due to continued expansion in domestic demand and a rebound in exports. On the domestic front, growth was mainly driven by stronger household spending reflecting favourable labour market conditions, policy measures to support households and healthy household balance sheets. In addition, strong investment approvals and further progress of multi-year projects by the private and public sectors, which includes catalytic initiatives under national master plans (i.e. New Industrial Master Plan, National Energy Transition Roadmap, and National Semiconductor Strategy) provided further impetus to investment growth. On the external front, exports recovered amid steady global growth, continued tech upcycle as well as higher tourist arrivals and spending. This provided support to the current account, leading to a continued surplus of 1.7% of GDP in 2024 (1.5% in 2023). Headline and core inflation averaged 1.8% in 2024, representing a two-year consecutive decline since 2022. Bank Negara Malaysia adopted a measured policy approach in 2024, maintaining the Overnight Policy Rate at 3% throughout the year.

The currency markets in 2024 experienced significant fluctuations driven by monetary policy shifts, geopolitical risks, and global trade imbalances. The USD remained strong in the first half of the year, supported by high interest rates and safe-haven demand, but weakened in the latter half as the Federal Reserve signalled potential rate cuts. The Euro remained stable, trading in the $1.05-$1.10 range against the USD, as the European Central Bank balanced inflation control with growth concerns. The GBP traded between $1.22-$1.30, influenced by the UK’s sluggish growth and high borrowing costs. In Asia, the Chinese Yuan (CNY) saw depreciation pressures, falling to around CNY 7.3 per USD, as China's weak economic momentum and capital outflows weighed on investor confidence. Emerging market currencies were volatile. The Malaysian Ringgit (MYR) was Asia’s best performing currency in 2024 after rising over 6% to close at 4.47 against the USD, thanks partly to stronger-than-expected economic growth. Coordinated efforts to encourage inflows have also aided.

Global equity markets experienced varied performances across regions. The MSCI World ex USA Index, which tracks large and mid-cap equities across 22 developed markets excluding the United States, posted a modest gain of 4.7% for the year. This represents a significant deceleration compared to the 18.6% increase observed in 2023. US equity markets continued their strong performance, building on the momentum from the previous year. The S&P 500 Index rose by 25%, marking its second consecutive year with gains exceeding 20%—a feat not achieved since 1998-1999. This robust performance was largely driven by technology stocks, particularly NVIDIA, which delivered a remarkable 171% return in 2024 due to strong demand for its AI chips and contributed significantly to the S&P 500's overall performance. Magnificent Seven stocks contributed more than half of the index’s total returns, with these seven companies alone accounting for approximately 53.7% of the index gain. This substantial impact highlights the dominant role these tech giants played in driving the overall market performance during 2024. As of the end of 2024, the combined weighting of the “Magnificent Seven” stocks is now approximately 33.7% of the S&P 500's total market capitalisation.

In Europe, the MSCI Europe Total Return Index, which measures the performance of large and mid-cap equities across 15 developed European countries, recorded a total return of 2.4%. This represents a significant decrease compared to the 20.7% return achieved in 2023. MSCI data showed that European stocks underperform US stocks by the most in at least 25 years. Several factors contributed to the subdued performance in 2024. European financial markets faced challenges due to concerns over U.S. tariffs and political instability in countries like France and Germany. The UK’s FTSE 100 posted a rise of 5.7% for 2024, its strongest annual gain since 2021. In Asia, Japan's Nikkei 225 Index climbed by 19.2%, bolstered by corporate governance reforms and signs of economic revitalisation. Notably, in February 2024, the Nikkei surpassed its previous all-time high set in 1989, reflecting renewed investor confidence and marking a significant milestone in Japan's financial markets. This performance was underpinned by strong corporate earnings and a favourable economic environment.

China's CSI 300 Index, which tracks the top 300 stocks traded on the Shanghai and Shenzhen stock exchanges, experienced a 14.7% increase in 2024, while the Hang Seng Index experienced a 17.7% increase in 2024, marking the first annual increase in five years, ending its four-year losing streak. This was influenced by various factors, including supportive government policies aimed at bolstering the economy and restoring investor confidence. Overall, 2024 marked a notable recovery for the CSI 300 and Hang Seng Index, reflecting the resilience and potential of China's equity markets.

Back home, 2024 was a strong year for Bursa Malaysia, with indices across different market segments showing significant gains. Large-cap stocks saw a steady rise where the FBM KLCI (30 largest companies) posted a 12.9% increase, while the FMB EMAS index which consists of 98% of the total market capitalisation of all Bursa listed companies posted an even better 16.3% increase, with mid and small-caps outperforming large-caps in Bursa. In the region, Singapore's Straits Times Index achieved a total return of 23.5% in 2024, marking its strongest performance in over a decade. The Philippine Stock Exchange and Indonesia’s IDX Composite Index closed 1.2% and 2.7% higher while Thailand’s SET All-Share Index declined by 0.8% for the year.

2024 IN REVIEW

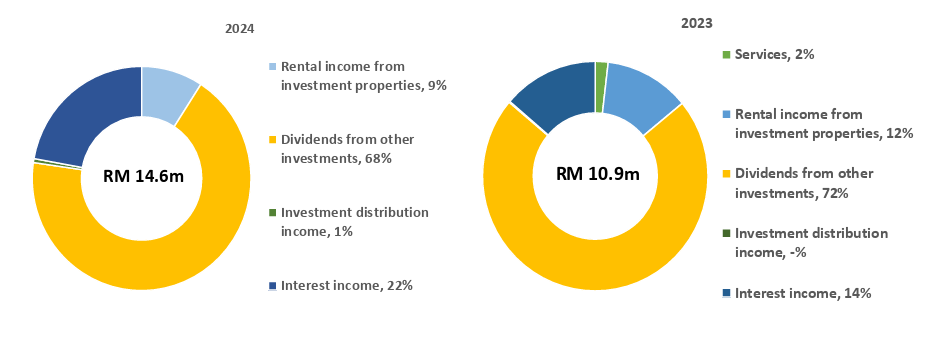

During the year, the Group generated revenue from services, rental of office space, dividends, interest and other investment income. The Group’s revenue mix for 2024 and 2023 are as depicted below:

As the Group is principally in investment holding, the biggest contributor to group revenue is dividends from equity investments at 68% of revenue or RM9.96 million in 2024. This is followed by interest income at 22% and together with dividend income, contribute 90% of group revenue. Rental income and investment distribution income combined to contribute the remaining 10% of group revenue. The decrease in the contribution of dividend income from 72% to 68% of group revenue in 2024 was mainly due to the increase in interest income generated on the Group’s cash in line with the increase in the Group’s cash in 2024.

Total revenue had increased by 34.0% in 2024 primarily from an increase in dividend income from equity investments from RM7.86 million in 2023 to RM9.96 million in 2024 and an increase in interest income from RM1.50 million in 2023 to RM3.24 million in 2024. Dividend income from equity investments had increased by 26.7% year-on-year as the size of the new equity portfolio increased from a total cost of RM91.2 million at the end of 2023 to RM147.5 million at the end of 2024 as a result of additional investments made during the year. During 2024, the Group continued to receive dividends amounting to RM9.86 million from its associate, 104 Corporation, although such dividends are not accounted for as revenue.

Interest income had increased by 116.4% YoY from RM1.50 million in 2023 to RM3.24 million in 2024 driven in part by the increase in cash as the Group continued to dispose shares of 104 Corporation, slower than anticipated re-investment of the proceeds coupled with the relatively high interest rate environment that had still prevailed throughout 2024. Although the US Federal Reserve had cut interest rates by a total of 100 basis points in the last 4 months of 2024, US dollar denominated deposits still enjoyed relatively high interest rates which benefitted the Group as some of the proceeds from the disposal of 104 Corp’s shares as well as dividends from investments abroad were converted into USD and deposited into foreign currency term deposits.

Rental income from investment properties stayed flat at RM1.33 million in 2024. The total area leased to the tenant is approximately 23,700 square feet which is about 87% of the net lettable area in Wisma JcbNext. The Group retains approximately 13% of Wisma JcbNext for its own use. As reported in the Annual Report 2021, the tenant for Wisma JcbNext has formally notified the Company of its intention to move out by 28 February 2023, with the option of extending the tenancy by another 6 months if needed. Since then, the tenant has exercised several options to extend the tenancy, with the latest extension taking the tenancy to 31 August 2025. During the year, the Group sold its other investment property, a 2-storey shoplot office in Johor, for RM800,000.

The Group did not derive any revenue from the provision of services in 2024 following the sale of the Group’s former subsidiary in Japan, which provided consulting services on a small scale, in 2023. In addition, the Group also did not invest to expand the Autoworld automotive content website in 2024 but continued to update the website.

The Group’s operating expenses in 2024 amounted to RM7.89 million, an increase of 69.7% compared with the previous year’s operating expenses of RM4.65 million. This was predominantly due to foreign exchange losses which are included in operating expenses. The Group recorded foreign exchange losses of RM3.27 million in 2024 in contrast to foreign exchange gains of RM1.18 million recorded in 2023 (which was included in Other Operating Income). The foreign exchange losses were mainly from the Group’s USD and SGD denominated bank deposits. During the year, MYR had strengthened against the USD and SGD from USD1:RM4.598 and SGD1:RM3.4825 at the end of 2023 to USD1:RM4.477 and SGD1:RM3.2885 at the end of 2024. In fact, the MYR had been recognised as one of the top-performing currencies of 2024 in the Asian region.

Further breakdown of the Group’s other operating expenses

is as follows:

| Group |

2024

RM

|

2023

RM

|

| Foreign exchange losses |

3,271,445 |

- |

| Professional fees |

935,401 |

860,556 |

| Directors’ fees |

360,418 |

356,730 |

| Office expenses |

190,965 |

181,526 |

| Security costs |

179,691 |

173,806 |

| Utilities |

295,428 |

307,474 |

| Staff benefits |

128,400 |

122,173 |

| Quit rent and assessments |

65,693 |

66,733 |

| Travelling |

12,340 |

21,838 |

| Telecommunication |

11,846 |

18,036 |

| Insurance |

43,657 |

44,420 |

| Miscellaneous |

98,969 |

89,335 |

|

5,594,253 |

2,242,627 |

The Group continued to rely a great deal on our associates, primarily 104 Corporation, to contribute to the Group’s earnings in 2024. To recap, 104 Corporation is principally involved in the online job portal business and also provides executive search and HR consultancy services in Taiwan. 104 Corporation has been listed on the Taiwan Stock Exchange since 2006. Taiwan’s real GDP grew by 4.6% in 2024, up from 1.3% growth in 2023 due to the increase in final consumption mainly driven by expenditures such as domestic shopping and services, outbound tourism, and higher securities and funds transaction fees due to robust financial market. Taiwan’s economy relies a lot on manufacturing and trade given its geographical limitations and the global demand for its exports like semiconductors, electrical equipment, and machinery and mechanical appliances. Trade has historically been one of the largest contributors to Taiwan’s economic growth and continues to play a significant role today. Due to the sustained momentum in artificial intelligence and the strong demand for information and communication products, real exports of goods and services grew by 8.90%. Imports also grew by 18.31%. Looking at a longer time frame, the value of total export has grown from USD 274,601 million in 2010 to USD 474,996 million in 2024, growing at a compounded annual rate of 3.99%; the value of total import has grown from USD 251,236 million in 2010 to USD 394,365 million in 2024, growing at a compounded annual rate of 3.27%. Total trade value with re-imports & re-exports included is about USD 869,398 million, an increase of 10.88% from 2023 but remains lower than the peak of about USD 907,532 million in 2022. China and Hong Kong remain Taiwan's largest trade partners in terms of the value of total trades, followed by the United States and ASEAN. Since 2020, the value of total trades with these countries has increased by 6.96%, 90.0%, and 53.77%, respectively.

Under the aforementioned circumstances, 104 Corporation’s revenue in 2024 had increased marginally by 7.3% to NT$2.50 billion compared with NT$2.33 billion in 2023 with the growth attributed to the growth in its Job Bank, HR Academy, HR Portal, and Head Hunter business. Its profit before taxation increased by 2.9% YoY to NT$565.74 million compared with NT$549.96 million in 2023 while the net profit attributable to shareholders increased 3.9% YoY to NT$469.36 million compared with NT$451.56 million in the preceding year. The balance sheet of 104 Corporation remains solid with cash holdings of NT$3.10 billion at the end of 2024. 104 Corporation has recently announced a dividend of NT$14.14 per ordinary share representing 100% of their net profit attributable to shareholders for the 2024 financial year, which will be paid out later this year. During the year, the Group had continued to dispose a portion of its holdings of 104 Corporation in the open market and in the process, the Group recorded gains on disposal of the said shares amounting to RM34.03 million. It is important to reiterate that the reduction of our stake in 104 Corporation is primarily motivated by risk management as the investment in the company represented a concentration risk on the Group’s balance sheet. It is not a case where we want to ‘take profit’ by selling when the share price is high, or make a ‘trading profit’ by selling some shares now and buying back later. Going forward, the pace and quantum of selling 104 Corporation shares will depend on many factors including the liquidity of the shares and/or interest from third parties. Further, the need to reduce concentration risk will decrease as the rest of our portfolio grows. Our investments, including 104 Corporation, continue to be long-term in nature, with the objective of deriving dividend income and distributing those dividends onward to our shareholders. As at 31 December 2024, the Group has an equity interest of 13.45% in 104 Corporation, down from 18.65% a year ago. In line with the reduction of the Group’s equity interest in the company, our share of profit from 104 Corporation in 2024 amounted to RM11.17 million, down 18.3% from RM13.67 million in 2023. As mentioned earlier, the Group received dividend amounting to RM9.86 million from 104 Corporation in 2024, down 23.6% compared with RM12.90 million received in 2023, due to the lower shareholding and high dividend base in 2023.

Our other associate, Innity Corporation Berhad (“Innity”), is principally involved in the provision of technology-based online advertising solutions, to their customers in the Asia Pacific region, using in-house developed technology platforms. Innity’s role in the online advertising process is to serve as a one-stop centre for advertisers and advertising agencies in offering the 3 major functions of the online advertising process, namely Creative, Media and Research. In essence, the group assumes the role of the advertising agency, creative agency, media agency and researcher. Innity has been a listed company since 2008 and currently, its shares are traded on the ACE Market of Bursa Malaysia Securities Berhad (“Bursa Securities”). The group has an established presence in Malaysia, Hong Kong and China, Indonesia, Philippines, Singapore, Taiwan, Thailand, South Korea, Myanmar, Cambodia, and Vietnam.

Innity faced a volatile and uncertain business landscape in 2024 despite the good macro environment for advertising spend. According to Dentsu, Asia Pacific total ad spend is projected to grow by 4.2%, to reach USD 235.90B in 2024 and digital ad spend continues to make up the majority of total ad spend at 64.7%, increasing by USD 11.20 billion (7.9% growth rate) from 2023, to reach USD152.30 billion in 2024. Innity’s revenue declined by 1.62% to RM112.17 million in FY2024 compared with RM114.01 million in FY2023. Its Vietnam, Indonesia and Philippines business units registered revenue growth of 51.3%, 58.3% and 10.7% respectively in FY2024 whereas lower revenues were recorded in Malaysia, Singapore, Hong Kong and China, Taiwan, and Cambodia as compared to the preceding year. Its Malaysia business unit remained as the top revenue contributor in FY2024 followed by Vietnam and Philippines business units. The Hong Kong and China business unit follows closely in fourth. The Malaysia business unit suffered from declining revenue due to reduced digital advertising spending from large global agencies. These four business units contributed a combined revenue of RM96.70 million (2023: RM98.18 million) of external revenue, representing 86.2% (2023: 86.1%) of total group external revenue. The group incurred a higher loss attributable to shareholders of RM7.61 million in FY2024 as compared to a loss of RM1.10 million in FY2023 due to lower gross profit margin, higher operating expenses particularly from unrealised losses on foreign exchange results from overdue inter-company balances and withholding tax expenses withheld for overseas dividend payment from its Philippines business unit. Our share of loss from Innity in 2024 had increased to a loss of approximately RM1.54 million compared with a loss of approximately RM231,000 a year ago. As at 31 December 2024, the Group has an equity interest of 20.98% in Innity.

Overall, the Group’s net profit attributable to shareholders for 2024 surged 44.0% YoY to RM51.12 million from RM35.49 million in 2023. As explained earlier, firstly, this was due to higher revenue in the form of higher dividend and interest income coupled with stable operating expenses. Next, we have a significant increase in the gain on disposal of shares of 104 Corp from RM18.47 million in 2023 to RM34.03 million in 2024 owing to the significantly higher quantity of shares sold in 2024 and higher prices relative to 2023. Gains on financial assets classified as fair value through profit and loss are mainly in respect of the Group’s investment in money market funds (“MMF”) and the decrease from RM1.47 million in 2023 to RM0.88 million in 2024 was mainly due to higher allocation of funds to bank term deposits instead of to MMF in Malaysia. In addition, there was an RM0.50 million increase in the fair value of investment properties which was attributable to Wisma JcbNext. Share of profits from associates, however, recorded a 28.3% decrease YoY to RM9.64 million in 2024 compared with RM13.44 million in the preceding year which was mainly due to the decrease in the equity interest of 104 Corporation following the continued disposals of shares in that associate. Excluding the gains on disposal of shares of 104 Corp, the adjusted net profit attributable to shareholders for 2024 would have been RM17.10 million (2023: RM17.02 million).

Although earnings per share amounted to approximately 38.83 sen per share (2023: 26.88 sen), the Company will continue to pay dividends based on its free cash flow (“FCF”). The Group’s FCF for 2024 amounted to RM18.08 million, up 6.1% from RM17.05 million in the preceding year. The increase in FCF was attributed to higher dividends received from equity investments as well as the increase in interest income. To this end, the Board has declared an interim dividend of 7.0 sen per ordinary share which was paid on 31 December 2024. The Board does not recommend the payment of a final dividend at the forthcoming AGM.

The Group’s net assets attributable to shareholders grew by 10.4% YoY to RM399.72 million as at 31 December 2024 compared with RM362.15 million at the end of the previous year. On a per share basis, this translates to RM3.04 per share with the Company’s shares quoted at a price of RM1.63 as at 31 December 2024.

OVERVIEW OF INVESTMENTS AND CASH RESERVES

The Group’s assets under management comprise of:

| Group |

2024

RM’000

|

2023

RM’000

|

| Investment

properties |

18,500 |

18,800 |

| Investments in

associatesˆ (at market value) |

|

|

| - 104 Corporation

|

134,207 |

195,954 |

| - Innity |

9,945 |

14,040 |

|

144,152 |

209,994

|

| Financial assets

at fair value through other comprehensive income |

|

|

| - Lion Rock |

39,951 |

35,035 |

| - Other investments |

164,185 |

93,679 |

|

204,136 |

128,714

|

| Financial assets at fair value through profit or loss |

|

|

| - Money market unit trust funds |

20,400 |

34,621 |

| -Other investments |

- |

881 |

|

20,400 |

35,502

|

| Cash reserves |

|

|

| - USD |

29,223 |

28,591 |

| - HKD |

1,304 |

11,186 |

| - SGD |

54,148 |

31,660 |

| - RM |

1,121 |

2,280 |

| - Others |

1,002 |

351 |

|

86,798 |

74,068

|

|

473,986 |

467,078 |

^ In the audited financial statements, investments in associates are accounted for using the equity method pursuant to MFRS 128, Investments in Associates and Joint Ventures

The Group’s assets under management, which comprise investment properties, equity investments, associates at market value and cash and cash equivalents, grew 1.48% to RM473.99 million as at 31 December 2024 compared with RM467.08 million in the previous year. Dividends from equity investments including from 104 Corporation, interest income, rental income, increase in the fair value of equity investments including associates, net of operating expenses, would have increased AUM by approximately RM25 million. However, in FY 2024, an interim dividend totalling RM9.20 million was paid on 31 December 2024, in addition to the final dividend for FY 2023 totalling RM8.56 million which was paid on 25 July 2024. Another decrease to AUM came in the form of share buy-backs which totalled RM1.16 million in FY 2024.

The performance of the Group’s associates has already been detailed in the previous section of this report. The carrying value of the investments in associates on the Group’s balance sheet decreased by 31.0% to RM78.87 million in 2024 from RM114.23 million a year ago. Against the Taiwan dollar, the Ringgit had strengthened from NT$1:RM0.1493 as at end 2023 to NT$1:RM0.1363 and this contributed to a decrease of RM6.37 million in the carrying value of 104 Corporation on our balance sheet. Disposals of 104 Corporation shares during the year also contributed to a decrease of RM26.89 million in the carrying value of 104 Corporation. In addition, while the share of profit from 104 Corporation for 2024 amounted to RM11.17 million, the dividend received from 104 Corporation during 2024 based on its 2023 net profit amounted to RM9.86 million. As mentioned in previous years’ Annual Reports, while the dividend from 104 Corporation being an associate does not benefit the Group’s bottom line, the dividend provides liquidity for the Group to fund its working capital requirements and dividend payment to shareholders. The dividend from 104 Corporation alone accounted for 50% of total dividends received by the Group in 2024.

The largest investment under the FVOCI category is Lion Rock with a carrying value of RM39.95 million. Lion Rock is principally involved in the provision of printing services to international book publishers, trade, professional and educational conglomerates and print media companies. This is a business that the Group had invested in from 2011 to 2013 at a total cost of RM2.98 million. Subsequently, in 2014, Cinderella Media Group Ltd, the parent company of Lion Rock at that time in which we had a stake in then, rewarded its shareholders by declaring a dividend-in-specie of its stake in Lion Rock and spinning it off as a separate listed company on the Hong Kong Stock Exchange. As a result of that, the Group’s stake in Lion Rock had increased by an additional 36.5 million shares in 2014. At the end of 2024, the Group held an equity interest of approximately 7.0% in Lion Rock. For the financial year ended 31 December 2024, the dividend yield on Lion Rock was 11.33% (2023: 10.0%). During the year, the Group received RM3.81 million in cash dividends (2023: RM4.06 million) from Lion Rock. On 27 March 2025, Lion Rock announced second interim and special dividends totalling HK$0.10 per share (2023: HK$0.08) to be paid on 29 April 2025. The fair value of the Group’s investment in Lion Rock had increased by 14.0% in 2024 in line with the appreciation of its share price from HKD1.10 at the end of 2023 to HKD1.28 at the end of 2024.

Despite the challenging macro environment and sluggish illustrated book market, Lion Rock delivered a commendable performance in 2024. The group achieved a 4.1% increase in revenue to HK$2,668.59 million from HK$2,562.78 million in the previous year. Net profit attributable to owners grew by 15.7% to HK$214.41 million from HK$185.25 million in 2023. Based on the disclosures in Lion Rock’s Annual Report for 2024, this growth was primarily due to the improved performance of its print manufacturing business and higher profit contributions from Quarto after the completion of the tender offer. Currently, printed books appear to be exempt from the additional 20% tariffs on Chinese products. However, this exemption might change if the US administration reinterprets the exemption clause or introduces new ones to impose additional tariffs. Such a scenario could erode the competitive edge of Chinese printers in the US market. Lion Rock’s management has proactively prepared for potential tariff increases by expanding Papercraft manufacturing operations in Malaysia over the past few years. In 2024, the global book market experienced a robust fiction segment but faced significant challenges in the non-fiction/illustrated book segment. The US market, the largest book market globally, saw a 1% YoY increase in unit sales of printed books, according to Circana BookScan data. Other major markets, including the UK and Australia, also saw similar market performance. The Chinese book market remained soft in 2024, with the total book value sold in Mainland China contracting by 6%. Due to challenging local market conditions, more indigenous Chinese printers are competing for overseas book printing orders, leading to overcapacity and downward pressure on industry printing margins, leading to the closure of uncompetitive printing plants. Despite market weakness, the group’s performance validated its efforts over the past few years to diversify both vertically and geographically. Its venture into the publishing industry with Quarto has expanded its client network for its print manufacturing business. Geographically, its print manufacturing operations in Australia and Malaysia have proven to be strategically important as Trump 2.0 accelerates global supply chain evolution. These locations provide a stable production base and help mitigate risks associated with global supply chain changes. Additionally, Lion Rock’s "China Plus One" print service offering opens up flexible opportunities for its publishing clients. A significant portion of the cost of goods sold for printed books is paper costs. Currently, the paper price in China is about 30%-40% lower than in Europe and the US. While this price differential continues to provide a competitive advantage for book printers in China, Lion Rock expects the pricing gap between China-made paper and Europe-made paper to narrow. The potential resolution of the Russia-Ukraine conflict may lead to a decrease in energy prices, making paper production in Europe more economical in the long term. Lion Rock expects to continue expanding its capacity in Malaysia in response to the sustained demand for book printing in South-East Asia. In the near term, Lion Rock said that the reset at Quarto and President Trump's protectionist policies make matching the remarkable results of 2024 a challenge. However, the group has a comfortable balance sheet and a capable management team. Lion Rock foresees that their businesses will continue to be sustainable and it will maintain its current dividend payout ratio.

2024 was a relatively active year for the Group as far as investments go. During the year, the Group had invested an additional RM61.11 million (2023: RM6.48 million) into its investment portfolio. For ease of reference, this portfolio will hereinafter be referred to as the Equity Portfolio and it excludes Lion Rock, Hastings Technology Metals Limited (“Hastings”), the associates and the unquoted investments. Most of the companies in the Equity Portfolio are listed in Malaysia and Hong Kong/ China with a small portion in Singapore and Europe. As at 31 December 2024, the top 5 holdings made up 37% of the Equity Portfolio while another 29 stocks made up the remaining 63%. These investments as well as other targets emanated from research conducted internally in line with the Group’s investment objectives. Should the prices of these stocks move within our target buy prices, we may increase our investments in these stocks further as well as acquire other target stocks on our buy list. The Equity Portfolio generated approximately RM6.15 million in dividends for the Group in 2024 (2023: RM3.80 million). As at 31 December 2024, the fair value of the Equity Portfolio amounted to RM158.59 million, up 83.7% from RM86.34 million a year ago. To prevent any risk of front-running, the identities of the component stocks will be kept confidential save for any laws or regulations that require the Group to provide full disclosure.

|

Cost

of Investment

RM

|

Carrying

Value

RM

|

Fair

Value

RM

|

| 104 Corporationˆ |

44,044,304 |

67,167,834 |

134,207,107 |

| Innityˆ |

8,487,984 |

11,700,804 |

9,945,014 |

| Lion Rock |

17,799,453 |

39,951,128 |

39,951,128 |

| Other equity investments |

170,144,910 |

164,185,076 |

164,185,076 |

| |

240,476,651 |

283,004,842 |

348,288,325 |

^ Accounted for using the equity method pursuant to MFRS 128, Investments in Associates and Joint Ventures

Looking at the table above, the fair value of all of the Group’s equity investments combined including its listed associates as at 31 December 2024 was significantly above total cost owing to the large unrealised gains on 104 Corporation, Lion Rock and to a lesser degree, Innity (please be reminded that the unrealised gains on 104 Corporation and Innity, as associates, have not been recognised in the financial statements at all). The fair value of other equity investments remained below cost at the end of 2024 mainly due to the investment in Hastings and the underperformance of certain specific Chinese, Hong Kong stocks and unquoted investments.

The Group’s treasury management objectives are to ensure there is available liquidity when needed and to preserve our long-term purchasing power to acquire investments. In that respect, the Group has decided that the main currencies that it will maintain are MYR, USD, SGD and HKD. While the holding of such currencies may result in foreign exchange gains or losses and thus volatility to our P&L, the Group does not intend to actively manage or trade currency positions nor engage in any speculative activities. The Group’s MYR cash is placed in current accounts and money market unit trust funds while its USD, SGD and HKD cash are mostly placed in interest-bearing bank deposits. While the Group manages its treasury function conservatively to safeguard the Group’s interests, the focus of the Board and management is still on identifying new strategic investments and/or developing a broad portfolio of investments that can contribute to the future growth of the Group. To be able to capitalise on any opportunities as and when they arise without sacrificing unduly on the Group’s returns on its reserves, the Group will need to maintain an appropriate mix of long and short-term investments and cash.

FUTURE PLANS AND PROSPECTS

As the world moves through the first quarter of 2025, geopolitical tensions continue to shape global markets, casting a shadow over economic prospects. The wars in Ukraine and the Middle East remain unresolved, with peace efforts stalled and Western support for Ukraine straining resources. In the Middle East, despite intermittent ceasefires, instability persists, with the Israel-Hamas war and broader regional rivalries impacting energy and food security.

At the same time, global trade is facing increasing fragmentation. The trend of economic decoupling between the US and China has accelerated, with both sides imposing new trade restrictions, particularly in high-tech industries. US-China relations are a focal point, with trade disputes intensifying and new and additional tariffs on Chinese goods signalling a deepening geoeconomic confrontation. The US administration has continued tightening export controls on advanced semiconductor technology, while China has responded by ramping up domestic self-sufficiency in critical sectors. Despite these headwinds, China is making strides in technology and artificial intelligence. Companies like DeepSeek have emerged as serious challengers to Western AI dominance, with advancements in foundational models that rival those of OpenAI at a fraction of its cost while being open-sourced. This carries significant implications for both the global AI landscape and China's technological sector. Cheaper and more efficient open-source models allow Chinese firms and startups to integrate advanced AI without relying on expensive foreign proprietary solutions or leading-edge chips while accelerating AI applications across different industries in China and fostering innovation. Government-backed AI chip initiatives, aimed at reducing reliance on US semiconductor imports, are potentially reshaping the global AI race. Meanwhile, China’s robotics sector is undergoing rapid growth, driven by investments in automation, industrial robotics, and humanoid AI-driven robots. This shift positions China as a global player in next-generation manufacturing and AI-driven automation, even as its traditional growth drivers, such as real estate remain under pressure.

US CPI rose by 2.8% in February 2025 on an annual basis. Excluding food and energy prices, the core CPI also rose 0.2% on the month and was at 3.1% on a 12-month basis, the lowest reading since April 2021. The Fed maintained the benchmark interest rate between 4.25% and 4.5% during its March 2025 meeting. The median projection among Federal Open Market Committee (FOMC) members indicated two potential rate cuts in 2025, totalling 50 basis points. The Fed revised its 2025 GDP growth forecast downward to 1.7% from 2.1% and increased its core inflation projection to 2.8% from 2.5%, partly due to recent tariff implementations.

The US political landscape, following Donald Trump’s inauguration in January 2025, is a wildcard. His administration’s early actions, imposing 20% tariffs on Chinese imports and 25% on steel and aluminum globally, and much larger tariffs on “Liberation Day”, suggest a protectionist turn with tariffs as a tool to protect American workers, industries and sovereignty. His moves reflect a belief that the US has been disadvantaged in international trade for decades. The key motivations include addressing trade imbalances, countering “unfair” practices by other countries’ trade policies, reviving US domestic manufacturing, generating tax revenue to offset extension of tax cuts and using tariff threats as political leverage in negotiations. On April 2, 2025, dubbed "Liberation Day", the US implemented a significant set of tariffs aimed at reshaping global trade and boosting domestic industry. The policy includes a baseline 10% tariff on all imports from every country, effective April 5, 2025, with additional "reciprocal tariffs" targeting specific nations, starting April 9, 2025. These reciprocal tariffs vary by country, with notable rates including 34% on China (added to an existing 20%, totalling 54%), 20% on the European Union, 46% on Vietnam, 32% on Taiwan, and 24% on Malaysia, among others. Trump's stated goals are to protect American industries, encourage domestic manufacturing, and reduce reliance on foreign goods, while also generating revenue for tax cuts and debt reduction. He framed the move as a declaration of "economic independence," arguing it would reverse decades of trade deficits that he claims have harmed US national security and prosperity. However, economists and critics warn that these tariffs could raise consumer prices, stoke inflation, and risk a global trade war, as countries like China, the EU, Canada, and Mexico have signalled retaliatory measures. Indeed, China was quick to retaliate with a 34% tariff on US imports to China. In response, Trump threatened an additional 50%, bringing the total to 104%. China said it would “fight to the end” if the US “insists on provoking a tariff war or trade war” and immediately announced it would raise its own tariffs on American goods from 34% to 84%. The tit-for-tat trade war between two of the world’s largest economies precipitated a sharp decline in global stock markets and a surge in gold prices, reflecting uncertainty and fears of economic disruption. While some see potential for long-term gains in US manufacturing, the short-term costs and global backlash remain significant concerns. This shift is driving uncertainty, as allies like the EU and trading partners like Canada and Mexico brace for reciprocal measures. On 9 April 2025, just as the reciprocal tariffs were set to take effect, Trump in an abrupt U-turn announced a 90-day pause on the reciprocal tariffs while maintaining a 10% across-the-board tariff. The notable exception was China, with Trump raising the tariff charged on the country to 145%. Following Trump’s announcement, global markets surged with the S&P 500 soaring and closing the day’s trading up 9.5%, while the Dow Jones surged 7.9%.

In January 2025, the International Monetary Fund (IMF) adjusted its forecast for China's economic growth, projecting a 4.6% expansion for the year. This revision was influenced by China's reported 5% GDP growth in 2024, which exceeded the IMF's earlier estimate of 4.8%. The stronger-than-expected performance in 2024 provided positive momentum entering 2025. Additionally, fiscal stimulus measures introduced by the Chinese government were anticipated to further support economic activity. However, the IMF also highlighted potential challenges, particularly uncertainties in global trade policies that could impact China's economic outlook. The IMF underscored the importance of bolstering domestic demand to ensure sustainable growth, noting that an overreliance on external trade is not viable for an economy of China's magnitude.

In this environment of uncertainty and high volatility, we continue to maintain a disciplined investment strategy focused on building a diversified portfolio of long-term equity investments that generate stable dividend income. This approach is designed to weather market volatility while ensuring sustainable returns for our shareholders. While market conditions have presented challenges, we continue to view volatility as an opportunity to acquire high-quality assets at attractive valuations. Should markets present favourable entry points, we stand ready to deploy additional capital into strategic investments that align with our longterm objectives. As we move further into 2025, we will continue to navigate these uncertain times with prudence, focusing on value, resilience, and sustainable income generation. While trade tensions, geopolitical risks, and economic uncertainties persist, we remain opportunistic in identifying investment opportunities that align with our long-term goals. The Group also remains committed to delivering steady dividend income to shareholders while maintaining a vigilant stance on risk management. We believe that our disciplined approach will allow us to capitalise on market opportunities while safeguarding against potential downturns in this unpredictable economic environment.

|

| |

|

|

|

|