DISTRIBUTION POLICY

Sunway REIT has a long-term distribution policy of distributing at least 90% distribution payout ratio based on reported realised income. The distribution will be announced on a semi-annual basis.

Sunway REIT has distributed 100% of its reported realised income from FY20111 to FY2019 and committed to distribute at least 90% of distributable income from FY2020 thereon.

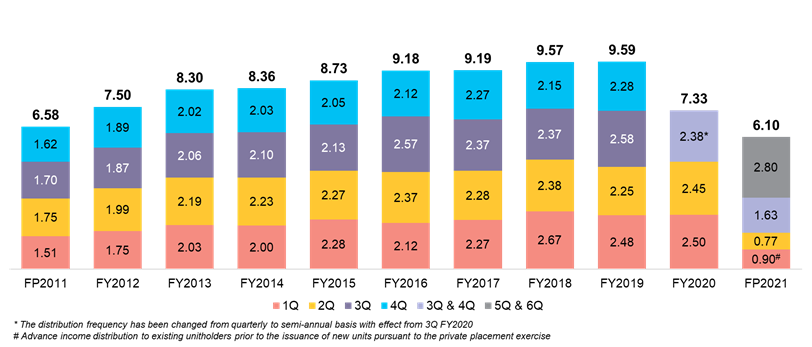

Distribution Per Unit (DPU) (FP20111 - FP20212) (sen)

1Sunway REIT was established on 20 May 2010 and the acquisition of the initial eight properties was completed on listing date, 8 July 2010. The financial results reported refers to the period from 20 May 2010 to 30 June 2011 (FP2011).

2Denotes financial period for the period from 1 July 2020 to 31 December 2021 pursuant to change in financial year to December 2021.

3Interim income distribution of 0.90 sen per unit (of which 0.55 sen per unit is taxable, 0.30 sen per unit is non-taxable and 0.05 sen per unit is tax exempt) for the period from 1 July 2020 to 30 September 2020 (inclusive).